A collection of bitcoin tokens. Bloomberg—Bloomberg via Getty Images

Digital currencies rally, but caution prevails

While

investing in the future is the way to go, it comes with risks and

rewards. The best strategy would be to not be in a rush. Do your

homework.

While

investing in the future is the way to go, it comes with risks and

rewards. The best strategy would be to not be in a rush. Do your

homework.

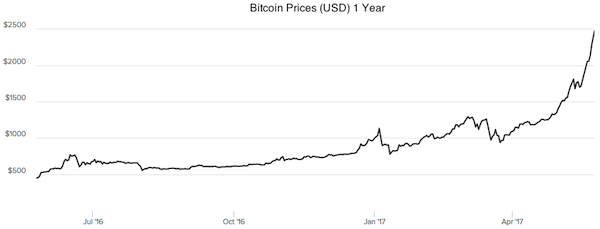

THIS week, the rally in crypto currencies is at its all-time high.

Bitcoin,

the pioneer in digital currency, surged to over US$1,700 per coin in

anticipation of a reversal in United States financial regulators’ ruling

to allow for an exchange-traded fund for Bitcoin and other factors.

Bitcoin was trading at US$935 on March 24. It rose 82%, pushing its market capitalisation to over US$28bil.

Ether, another such currency, surged from US$8 on Jan 1 to US$90 this week, gaining 1,125% in five months.

The

market capitalisation of the 700-over currencies is over US$50bil. The

promoters believe it is the currency of the future, hence the rise, but

the naysayers believe it is entering a speculative bubble.

But there are some who are ditching gold to mine Bitcoins.

It

is a fact that crypto currencies are gaining traction from their

inception in 2009. Now, at least 150 organisations including Apple,

Walmart, Sears, eBay, Overstock.com, Microsoft, Steam, Expedia and even

Subway accept them in exchange for goods.

So, what is Bitcoin then?

It

is a form of digital currency, created and held electronically, not

blocked by any nation or government, not printed like dollars and

ringgit but produced by people. Crypto currencies are digital currencies

that use encryption to secure transactions and control how new coins

are made.

You and I can get Bitcoins by “mining”

computers that validate blocks of transactions using software to solve

mathematical puzzles every 10 minutes. If you solve it first, you are

rewarded with new Bitcoins.

Bitcoin is the mother of all crypto currencies – also known as virtual currencies, digital currencies and private currencies.

Other

than Bitcoin and Ether, there is also Dogecoin, Augur, Chinacoin,

Litecon, Dash, Waves and Zcash. There are over 40 exchanges globally to

trade in Bitcoins.

All this came about because of

fintech, the financial services technology that is disrupting the

financial services sector with faster, cheaper and so-called “reliable”

transactions for money transfers, bank exchange rates and other

money-related transactions. The average clearance is a 12-hour period,

which apparently the banks cannot match.

In Brazil, people use Zcash to pay for their taxes, electricity bills and purchases.

This

week, Australia said there would be no double taxation for crypto

currencies and to treat it just like other currencies from July 1,

paving the way for greater usage.

Many are betting on crypto currencies because of the lure that they are the currency of the future. Would you?

Since 2009, there have been gainers and losers, so you decide.

All

these digital currencies came about because of the Internet and data.

The value of data and digital services is becoming more apparent, and in

the digital era, data is the new currency.

Amid all

this is blockchain, which is simply a digital ledger that keeps track of

Bitcoin transactions and transfers it globally. It boasts of

instantaneous transactions, transparent and cheaper than the traditional

ways. This is why banks are hurriedly getting their acts together in

the area of fintech so as to not miss the boat.

There

is a growing number of mergers and acquisitions and crowdfunding for

blockchains. Last month, music-podcast-video streaming service Spotify

bought over blockchain technology company Mediachain Labs to help reward

online content owners with royalty payments.

Other

telcos and IT firms are getting into blockchain because they don’t want

to miss out on anything. Other payment companies are getting into the

act too. There is just too much interest in this new wave of doing

things.

The journey of crypto currencies, however, is

not without hurdles, and there are plenty out there that cannot be

ignored. Even blockchain’s growth cannot be ignored, especially since it

is being positioned by those championing it as the de facto technology

of the future.

But will it really be all that or will it just add another layer to the overall cost?

All

these transfers do not need regulation as yet, something that central

bankers don’t like. In fact, Bank Negara is already in the thick of

things where fintech is concerned.

While investing in

the future is the way to go, it comes with risks and rewards. The best

strategy would be to not be in a rush. Do your homework, as there is

also the other side of Bitcoin – fake websites, fake online gaming

sites, trading, etc.

I bet you would know of someone

who has lost money mining Bitcoin or Ether. You honestly wouldn’t want

to be put in a spot like those caught up in the recent forex scam and

the earlier gold scam.

It would be good too to bear in

mind that the sweet spot of crypto currencies has been linked to

terrorism financing, money laundering, tax evasion and fraud.

Trust

and transparency have been the bedrock of financial institutions all

these years. Ensure your bedrock is solid, but at the same time,

remember what the former US Federal Reserve chairman Ben Bernanke had

said in a letter to US senators about virtual currencies, that they “may

hold long-term promise, particularly if the innovations promote a

faster, more secure, and more efficient payment system”.

Do

you think blockchain will bring trust and transparency to the world of

crypto currency? Share your thoughts with me at bksidhu@thestar

Source: The Star by

b.k. sidhu

Related Stories

US regulators to review decision blocking Bitcoin ETF’s listing

China central bank holds meeting with bitcoin exchanges

It’s the blockchain not the bitcoin

US regulators to review decision blocking Bitcoin ETF’s listing

China central bank holds meeting with bitcoin exchanges

It’s the blockchain not the bitcoin

Property in a digital era

WITH digital technology all the rage and taking the world by storm, we look at how science and automation has managed to change and revolutionise the way we do things, in this section, property.

While the internet has changed the way we receive information and connect with others and the smart phone transformed the whole concept of a phone, we now look at the evolution of finance and how purchasing items, including a house, is going through reform with the introduction of bitcoin.

Introducing bitcoin

When people hear terms like "bitcoin" and "blockchain", many are vague while some may not even be familiar with these words. But for the technology industry adept, bitcoin and blockchain is common as these new-age technology concepts and modus operandi have been around, perhaps less widely known in Southeast Asia as it is in the West and China.

For the uninformed and in the dark, bitcoin is a technology that has established a new electronic payment method using "digitised money" made with digital cryptography, otherwise known as cryptocurrency.

This system of payment is carried out when a user uses "bitcoin currency" (or cryptocurrency) to pay for goods by transferring the currency to another user (seller) within the bitcoin community.

Each transaction is recorded in a public data ledger known as "blockchain" and it is here where all the transactions that have taken place within the bitcoin community are stored.

The amazing thing about this system is that anyone in the bitcoin community is able to validate transactions that take place without the need of an intermediary.

Sound too good to be true and a little risky? Well, the reason there is no intermediate party necessary is due to the network bitcoin technology is regulated on.

Modus operandi and more

The bitcoin network is founded on a "peer-to-peer network system (P2P network)" which is explained as "a network of computers/ mobile configured to allow certain files and folders to be shared with everyone or with selected users".

As a result, the "participants" are in control of their transactions, making everyone equal within the bitcoin community, which is also transparent.

It is said that bitcoin technology was first created in 2008 by a person or a group of persons under the pseudonym "Satoshi Nakamoto" in a research paper. The research stated that there was need for a new electronic payment method, one using digitised money. The analysis also included the future of bitcoin, its benefits, capabilities and potential.

The system was implemented on Jan 3, 2009. And after just a few years, bitcoin grew to become a whopping US$12 billion (RM52.7 billion) globalised economy.

Bitcoin attributes

While not much has been said about bitcoin in this part of the region, the system has been around, slowly developing and growing. Like many things that are cloudy and not often talked about, people are weary hence, there will be sceptics who dissuade others about the system they themselves are unclear about.

With that, theSun's Brian Chung shares what he learnt of this new method of transaction and currency when he attended a talk by renowned entrepreneur, author and expert on bitcoin Andreas M. Antonopoulos.

Below, Antonopolous shares important information on bitcoin.

1) Bitcoin is an open system of payment: It is a system that anyone can access, participate and innovate, and does not require permission. Bitcoin allows anyone to join in and use the system, validate the transaction and create different kinds of cryptocurrency.

2) Bitcoin is borderless: Like the internet, bitcoin is not restricted to a country's rules and regulations as it has its own protocol with no distinction across countries.

3) Bitcoin is neutral: Bitcoin does not take the identity of the participant into any consideration. It only validates the transaction that takes place between participants. This attribute also allows participants to remain anonymous.

4) Bitcoin is censorship resistant: Every transaction in the bitcoin network cannot be frozen, censored or canceled. Like the internet, the bitcoin system is a global digital economy with one currency.

5) Bitcoin is a decentralised system: The bitcoin network has no central institution or centre point of control. This trait ensures that there is no one major target for hackers to concentrate their attacks on. Instead, hackers have to create attacks on every single participant's software with different forms of virus and codes to hack into one computer.

6) Bitcoin is scarce and limited: Bitcoin is a system of value like gold but in digital form. This makes it a system that is not based on credit and debit. It also makes bitcoin a singular global currency with no exchange rate between countries.

7) Every bitcoin transaction is permanent and immutable: The transaction of everyone in the community is verified by everyone in the system. Once it is verified, the transaction will be permanently recorded in the blockchain.

8) Bitcoin is a constantly innovative technology: The open source nature of the bitcoin technology allows other people to further improve on it. There are many other cryptocurrencies based on the bitcoin technology. Moreover, the bitcoin technology is dependent on the internet, which makes improvement and innovation necessary.

Bitcoin transactions can be done via smart phones and computers by downloading the application and software. Users do not need to register themselves to be part of the bitcoin network as all "participants" are referred to by codes and "signature of one's device".

However, iPhone users need to remember their iTunes password to download the application. In addition, the device that one has downloaded the bitcoin software on must remain connected to the internet in order for one to use the bitcoin method of payment.

Follow our column next week on the application of bitcoin in property.

[Note: All charts courtesy of Bitcoin Malaysia.]

The application of bitcoin in property

WHILE last week, we introduced the term bitcoin to those oblivious of this new age cryptocurrency and system of payment, this week, we share bitcoin whiz Andreas M. Antonopoulus' insights on how this technology is applied in property. Here is what he had to say:

Permanent records

"One very common application is the registration of assets or ownership of tangible and

non-tangible things like the registration of title over land and the ownership of assets

like homes.

When you record something on blockchain, it cannot be modified ... it is immutable. Once recorded on the blockchain, the system of trust prevents anyone from reversing or overwriting it. That makes a record on blockchain permanent, an immutable record which is really important in real estate transaction as it allows one to pass the title of a piece of land from person to person independently with no one being able to falsify the record or steal land through paper," Antonopoulos said.

Moreover, he mentioned that this technology can benefit the industry tremendously as it is able to resolve a huge problem in real estate and property transactions – the falsification of strata titles and property documents.

His view is further enhanced with the emergence of another bitcoin-based system, ethereum. Like bitcoin, ethereum has its own cryptocurrency known as ether. However, ethereum adopts a different technology that is based on the blockchain public ledger system known as Smart Contract.

According to Antonopoulos, a smart contract is an electronic contract with all the contractual obligations of the buyer and seller. The contract is written and coded into an application, which will ensure both parties fulfill their obligations.

Like blockchain technology that is built on trust and verification, these contracts are encoded in a public ledger in the ethereum community. If anyone tries to forge the contract, the ledger will reject it. As such, this smart contract cannot be rewritten and altered as it is a permanent and immutable contract.

Direct transactions

Besides the use of a contract, the technology will make transactions direct, fast and secure.

Antonopoulos also shared about the removal of third parties and its altered role. He said, "Another example relevant to real estate application is the function of escrow. In order to do make transactions for real estate today, people have to use a third party agent, an escrow agent. This escrow agent charges a significant amount of money in most countries. During the process, that agent holds custody of the entire fund, which is dangerous. This means that the escrow agent has to be carefully vetted and have foresight.

Bitcoin can replace all of this by using multi-signature, which allows the seller and buyer to transact escrow programmatically, with the third party acting as mediator only in the case of a dispute.

Buyer and seller will be able to execute a transaction on their own without the need of an escrow agent and without any of the parties having custody of the entire fund. Through bitcoin, you do not need to spend that additional one percent of the sale of the house – the escrow agent is no longer necessary.

It can also change the speed of escrow by doing it in hours instead of a month and changes the security because no one of the three parties can run away with the money. It is faster, cheaper and secure. It can be done in other industries related to real estates like purchasing assets, corporation, mergers and acquisitions.

International property purchase

With the use of decentralised digital currency, one can assume that purchasing items and properties is a little easier, and it is.

The chance of purchasing international property is further reinforced by the fact that bitcoin is not controlled by anyone, not even political and banking institutions. This attribute of bitcoin makes it easier for people buying property from another country. Although each country has its regulations, the use of bitcoin to purchase property abroad saves time and money as one does not need to change currency.

The Australia Real Estate website has stated that there are properties in the United States and Latin America being sold using bitcoin. The Wall Street Journal wrote an article in 2014 regarding a Lake Tahoe property, which was sold for US$1 million in bitcoin.

Follow our column next week for more interesting information on bitcoin, its challenges and how stable a cryptocurrency it is.

By rian Chung

Related articles:

In a statement filed with the Singapore Exchange, Wira Dani(filepic) indicated that he intended to settle personal affairs following the court bankruptcy order, which he intends to resolve within the next 30 days.

In a statement filed with the Singapore Exchange, Wira Dani(filepic) indicated that he intended to settle personal affairs following the court bankruptcy order, which he intends to resolve within the next 30 days.